Stonk O Tracker Gme – Unlock Your Wealth!

The Stonk O Tracker GME might be just what you need. This tool offers insights and updates to help you stay informed about your investment in GameStop.

Stonk O Tracker is a tool for keeping an eye on stocks. It displays stock prices, Short Sale Restriction (SSR) data, shares available for borrowing and shorting, the volume of shorted shares, and calls In The Money (ITM) for specific stocks.

In this article, we’ll look into the critical features of Stonk-O-Tracker and how it helps traders. We’ll also talk about its limits and how it works with other tools like iBorrowDesk, which monitors borrow rates for short-selling stocks.

What Is Stonk O Tracker Gme? – Dive Into The Information!

Stonk-O Tracker GME is a specialized tool designed for GameStop (GME) stock investors, offering real-time insights into its performance.

Developed to cater to investors with varying experience levels, the tracker provides accessible information, including trends, statistics, and critical tables.

Users can navigate the site to gain a comprehensive understanding of GME’s stock movements, aiding them in making informed decisions.

It’s essential to note that while the tool is widely used, there’s ongoing discussion regarding its accuracy, prompting investors to approach its data with a discerning eye and complement it with a broader understanding of market dynamics.

Where Did The Stonk O Tracker Come From? – Click To Unravel The Mystery!

The simple explanation for the Stonk-O-Tracker’s origin is that it is a retail trader aiming to offer current information about two highly searched stocks online. But why focus on AMC and GME? The story behind that choice goes back a bit further.

1. Meme Stocks:

In 2020, regular people started to invest more using apps like Robinhood and WealthSimple. This led to some brands and companies becoming trendy choices for investing, almost like they had a unique following in the market.

These companies, such as AMC and GameStop, were called “meme stocks” because they became popular on social media platforms like Reddit. Amateur investors often gathered there to talk about their discoveries.

Even though many meme stocks have become less popular, AMC and GameStop still attract much attention. This is partly because well-known investors like Elon Musk and Ryan Cohen are involved with them.

2. Short Squeeze:

These two stocks stood out to social media because hedge funds placed bets that the traditional media companies would struggle, creating short positions.

GameStop, a popular video game store cherished by many online personalities, and AMC, a well-known movie theater chain, were among the stocks heavily shorted on Wall Street.

Without delving into every detail of how they became prime targets for online retaliation, particularly investor Keith Gill’s involvement, a significant demand arose for real-time updates about AMC and GME stocks.

Here’s where the Stonk-O-Tracker comes in handy. It’s designed to help new traders stay informed about stocks, especially those following the r/wallstreetbets Subreddit.

How To Read The Stonk O Tracker? – Dive Into The Information!

Keeping up with all the trends and numbers can take time for regular investors with about $1,500 in their trading accounts. Understanding what the Stonk-O-Tracker website is monitoring can be even more complicated.

Before diving deep, it’s important to note that there’s an ongoing debate about the accuracy of the Stonk-O-Tracker. Even if it’s reliable, investors should aim for more than just a basic understanding of the stats before investing large amounts.

If you’ve checked out the site, figuring out where to begin might feel overwhelming. Let’s simplify things by explaining some of the main tables and what they track.

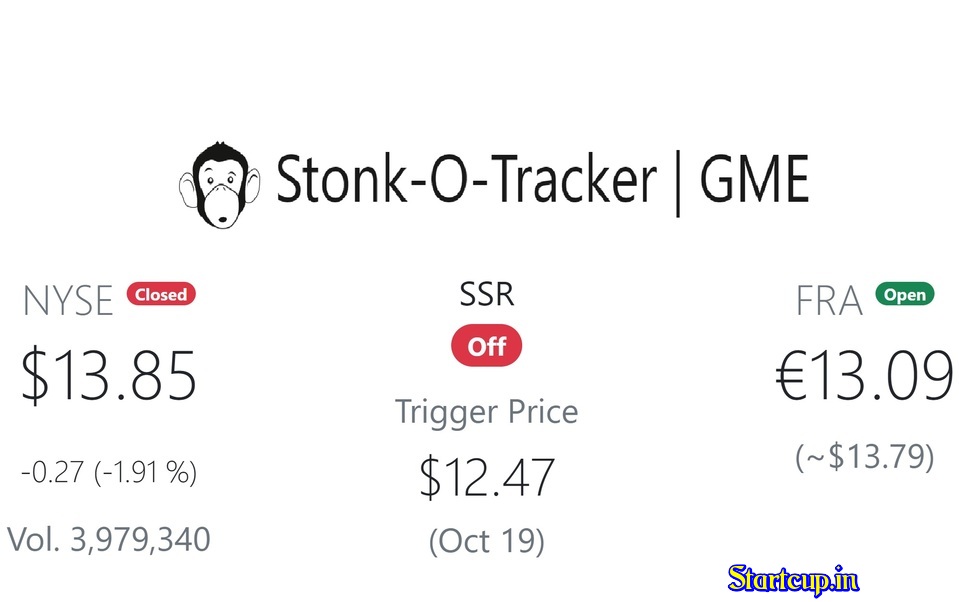

1. Share Price And SSR:

At the top of the page, you’ll notice three numbers. The first shows the current price of the New York Stock Exchange (NYSE) and its change for the day. On the right side, you’ll find the price on the Frankfurt Stock Exchange (FRA), Germany’s largest exchange.

In the middle, you’ll see a number labeled SSR Trigger Price. This refers to Short Sale Restriction, a rule on the NYSE that limits short-selling if the stock price is already falling that day. The threshold is 10% below the previous day’s closing price, known as the reference.

Let’s say AMC’s stock closed at $16 on Tuesday. It gets put on the SSR list if it falls below $14.40 during Wednesday’s trading.

This stops short-selling until the next trading day. This rule helps manage the risks of very unpredictable stocks.

2. Trading Volume:

On the website’s main page, trading volume reports are updated every 30 minutes, and you can also access minute-by-minute data.

This helps investors see how actively a particular stock is being traded, which can help predict market changes.

For instance, a sudden increase in trading volume could signal that a stock is gearing up for a significant change.

3. Borrowed Shares:

This table shows how many shares short sellers can borrow. The middle number from Interactive Brokers indicates if the stock is heavily shorted. If this number decreases, it suggests more short positions are being taken.

4. Option Data:

Here, you can find information about calls and puts. It shows when each contract expires and whether the option is In The Money (ITM) or Out of The Money (OTM).

Let me break it down: A call lets an investor buy a stock at a set price on a specific date. If the stock rises above that price by the date, the call is ITM.

On the flip side, a put is a bet that a stock will be worth less than the agreed-upon price.

Other tables are on the site, but they’re easy to understand. The Dark Pool percentage data, which tried to estimate shares traded privately, has been removed.

Frequently Asked Questions:

1. Is Stonk O Tracker Gme Suitable For Beginners?

Absolutely! Stonk-o Tracker GME is designed to be user-friendly and accessible to investors of all experience levels.

2. Can I Use Stonk O Tracker Gme On My Mobile Device?

Yes, Stonk-o Tracker GME offers mobile compatibility, allowing you to track your investments.

3. Are There Any Subscription Fees Associated With Stonk O Tracker Gme?

Stonk-o Tracker GME offers free and premium subscription options, giving you flexibility based on your needs and budget.

4. How Accurate Is The Data Provided By Stonk O Tracker Gme?

Stonk-o Tracker GME utilizes cutting-edge technology to deliver accurate and reliable real-time data, ensuring you have access to the most up-to-date information.

Conclusion:

Stonk-o Tracker GME is your ticket to financial success in stock trading. With its robust features, intuitive interface, and commitment to accuracy, it’s no wonder why investors around the globe are turning to Stonk-o Tracker GME to maximize their returns.

Read More: