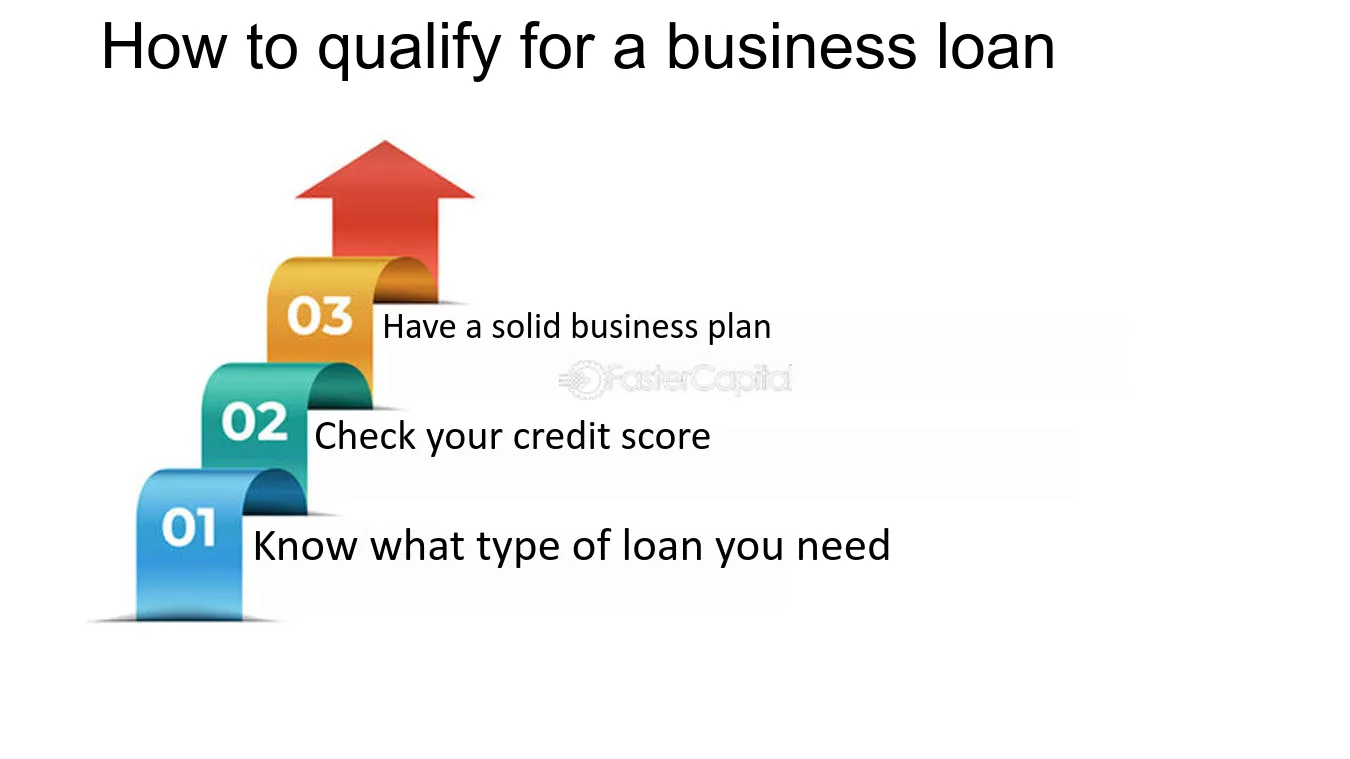

Essential Steps: How to Get a Business Loan?

Securing a business loan is often pivotal for entrepreneurs looking to expand operations, manage cash flow, or launch new initiatives. Understanding the process and preparing thoroughly can significantly increase your chances of approval. Scroll down to learn about the essential steps on how to get a business loan.

1. Assess Your Financial Needs

Begin by evaluating why you need the loan and how much capital is required. Whether it’s for purchasing equipment, hiring staff, covering operational expenses, or scaling your business, a clear understanding of your financial needs is crucial. This assessment helps you determine the type and amount of loan that best suits your business objectives.

2. Check Your Creditworthiness:

Lenders will scrutinize your credit history to assess your loan repayment ability. Obtain copies of your personal and business credit reports from major credit bureaus and review them for accuracy. A strong credit score improves your chances of securing favorable loan terms.

Address any discrepancies and work on improving your credit profile if necessary before applying. Entrepreneurs today have more financing options than ever, with Business Loans Canada or elsewhere available through both traditional institutions and online platforms. These options vary in terms of eligibility, interest rates, and repayment flexibility, allowing business owners to find solutions that fit their goals and financial circumstances.

3. Research Loan Options

When you’re researching how to get approved for a business loan, you should explore the different types of business loans available, such as term loans, SBA loans, lines of credit, equipment financing, and invoice financing. Each type has unique features, eligibility criteria, interest rates, and repayment terms. Research multiple lenders, including banks, credit unions, online lenders, and government-backed programs, to find the best fit for your business needs.

4. Prepare Your Business Plan

Craft a comprehensive business plan that outlines your business goals, market analysis, competitive landscape, products or services, marketing strategies, and financial projections. Clearly articulate how the loan will be used to achieve growth and repay the borrowed funds. A well-structured business plan demonstrates your preparedness and vision to lenders.

5. Gather Required Documentation

Organize necessary documentation to support your loan application, which typically includes:

Financial Statements: Balance sheets, income, and cash flow statements provide insights into your business’s financial health.

Tax Returns: Personal and business tax returns for the past few years verify your income and compliance with tax obligations.

Legal Documents: Business licenses, articles of incorporation, contracts, and any other legal documents relevant to your business operations.

Ensure all documents are accurate, up-to-date, and organized to streamline the application process and present a professional image to lenders.

6. Compare Lenders and Apply

Once prepared, compare loan offers from different lenders based on interest rates, fees, repayment terms, customer service, and eligibility requirements. Choose a lender with the most favorable terms aligned with your business’s financial situation and goals. Complete the application process carefully, providing accurate information and addressing any lender-specific requirements.

7. Review and Negotiate Terms

Upon receiving loan offers, carefully review the terms and conditions outlined in the loan agreement. Pay attention to interest rates, repayment schedules, fees, collateral requirements, and any prepayment penalties. If necessary, negotiate terms to ensure they align with your business’s financial capabilities and long-term objectives.

8. Await Loan Approval and Funding

After submitting your application, lenders will review your documentation, conduct credit checks, and assess the risk of lending to your business. Be prepared for potential follow-up questions or requests for additional information. Once approved, review and sign the loan agreement. Funds are typically disbursed directly to your business bank account, allowing you to start using them for approved purposes.

9. Manage Funds Wisely and Monitor Performance

Use the loan funds responsibly according to your business plan and financial projections. Monitor your business’s financial performance regularly to ensure you can meet repayment obligations and leverage the loan effectively to achieve growth and profitability.

By following these essential steps, you can confidently navigate the process of obtaining a business loan and maximize your chances of securing financing that supports your business’s success and expansion goals.